02-10

Zillow发布2022年美国房价预测:房价将飙升16%

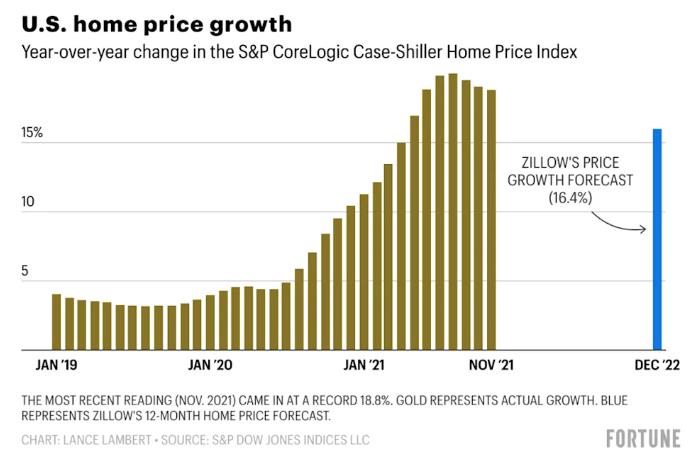

Homebuyers got crushed last year as home prices soared at their highest clip on record. Housing economists saw that price growth—which peaked at a year-over-year rate of 20% last year—as simply unsustainable. Their economic models agreed: Among the seven forecast models reviewed by Fortune heading into 2022, every single one predicted home price growth would slow significantly this year.

参考译文:去年,随着房价飙升至有记录以来的最高水平,购房者被压垮了。住房经济学家认为,价格增长(去年达到 20% 的同比增长率)简直是不可持续的。他们的经济模型一致:在《财富》杂志审查的进入 2022 年的七个预测模型中,每个模型都预测今年房价增长将显着放缓。

But over the past few weeks, that consensus is no longer so unified. Now, more industry insiders are throwing out their previous forecasts and replacing them with more bullish short-term outlooks. Indeed, some experts say the 2022 spring housing market might go down as one of the most competitive on record.

但在过去的几周里,这种共识不再那么统一了。现在,越来越多的业内人士抛弃了他们之前的预测,取而代之的是更乐观的短期前景。事实上,一些专家表示,2022 年春季房地产市场可能会成为有史以来最具竞争力的市场之一。

Look no further than Zillow. Back in December, the home listing site predicted that U.S. home values would climb 11% this year. Economists at Zillow now say that forecast is too conservative. Their latest forecast finds home prices are set to spike 16.4% between December 2021 and December 2022. If it comes to fruition, it would mark another brutal year for home shoppers.

看看 Zillow。早在去年 12 月,这家房屋上市网站就预测今年美国房屋价值将上涨 11%。 Zillow 的经济学家现在表示,这种预测过于保守。他们的最新预测发现,房价将在 2021 年 12 月至 2022 年 12 月期间飙升 16.4%。如果实现,这将标志着购房者又一个残酷的一年。

Why is Zillow raising its 2022 home price growth forecast? A lot of it boils down to housing inventory. During the pandemic, inventory plunged to a four-decade low as more buyers rushed into the market. That trend was predicted to reverse late last year as forbearance protection programs lapsed and mortgage rates rose. But not only has that not happened, the inventory situation has gotten worse. In January, there were just over 923,000 U.S. homes listed for sale on Zillow. That’s down 40.5% from the pre-pandemic level in January 2020, and down 19.5% from January 2021.

为什么 Zillow 上调 2022 年房价增长预测?其中很大一部分归结为住房库存。在疫情期间,随着更多买家涌入市场,库存暴跌至四年低点。随着宽容保护计划失效和抵押贷款利率上升,预计这种趋势将在去年底逆转。但这不仅没有发生,库存情况还变得更糟。 1 月份,在 Zillow 上挂牌出售的美国房屋超过 923,000 套。这比 2020 年 1 月疫情前的水平下降了 40.5%,比 2021 年 1 月下降了 19.5%。

Simply put: The housing market is tighter right now than it was last year when bidding wars climbed to an all-time high. That explains why Zillow foresees a rough few months ahead for home shoppers.

简而言之:现在的房地产市场比去年竞购战攀升至历史新高时更加紧张。这就解释了为什么 Zillow 预计家庭购物者将面临艰难的几个月。

But there is a big wild card: As the Federal Reserve shifts policy to help tame inflation, its moves will indirectly result in higher mortgage rates. In fact, the average 30-year fixed mortgage rate in January already spiked to 3.56%—up from 3.11% in December. That marks the biggest one-month jump in mortgage rates in more than nine years.

但有一个很大的不确定性:随着美联储改变政策以帮助抑制通胀,其举措将间接导致抵押贷款利率上升。事实上,1 月份的 30 年期固定抵押贷款平均利率已经从 12 月份的 3.11% 飙升至 3.56%。这标志着九年多来抵押贷款利率的最大单月涨幅。

In the short term, more buyers might rush into the housing market in order to lock down rates before they go higher. But in the long term, higher mortgage rates would put downward pressure on price growth. Why? As mortgage rates rise, some buyers get locked out of the market altogether.

“Downside risks to our forecast remain,” write the Zillow researchers. “Elevated inflation heightens the risk of near-term monetary policy tightening, which would result in higher mortgage rates and weigh on housing demand…Higher rates are exacerbating buyers’ struggles with affordability, and they might dissuade some existing homeowners from moving, by raising the monthly mortgage cost of even those homes priced similarly to their current homes. By dampening both buyers’ and sellers’ appetite in this market, rising rates could drive down sales volumes this year, with uncertain effects on home prices.”

在短期内,更多的买家可能会涌入房地产市场,以便在利率走高之前锁定利率。但从长期来看,较高的抵押贷款利率将对价格增长带来下行压力。为什么?随着抵押贷款利率的上升,一些买家被完全排除在市场之外。 “我们预测的下行风险仍然存在,”Zillow 研究人员写道。 “通胀上升加剧了近期货币政策收紧的风险,这将导致抵押贷款利率上升并给住房需求带来压力……更高的利率加剧了购房者在负担能力方面的挣扎,他们可能会通过提高房价来劝阻一些现有房主搬家。即使是那些价格与当前房屋价格相似的房屋的每月抵押贷款成本。通过抑制买家和卖家在这个市场的胃口,利率上升可能会导致今年的销量下降,对房价产生不确定的影响。”

Homebuyers and sellers alike would be wise to take Zillow’s 16.4% price growth prediction—or any other real estate forecast model—with a grain of salt. After all, none of the major real estate forecast models predicted the historic home price boom we’ve seen over the past two years. Indeed, when the pandemic struck in spring 2020, Zillow and CoreLogic both predicted home prices would fall by spring 2021.

购房者和卖家都对 Zillow 的 16.4% 的价格增长预测——或任何其他房地产预测模型——持保留态度是明智的。毕竟,主要的房地产预测模型都没有预测到我们在过去两年中看到的历史性房价上涨。事实上,当大流行在 2020 年春季爆发时,Zillow 和 CoreLogic 都预测到 2021 年春季房价将下跌。

声明:本文来自FORTUNE,版权属于原作者。

标签: 美国房产;美国房价趋势

威翰地产 Windham Realty Group

始于1967年的房地产投资开发及10余年的海外房产经纪服务经验,为中国投资者提供最优质的美国房地产投资项目和一站式经纪咨询服务。

免费订阅微信公众账号"威翰地产"

微信搜索"windhamchina"或扫描左侧微信二维码

订阅美国房产实时资讯 EDM